This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

How to reconcile e-commerce with air cargo

How to reconcile e-commerce with air cargo

Originally published in LinkedIn on 18 March, 2020.

(Due to current coronavirus pandemic, prices and capacity situation has changed, so has the overall market condition. COVID-19 is a global force majeure. However, once the pandemic is subdued, there will be a renewed need to reconcile ecommerce with air cargo and come up with new business and operational modes).

As private or public consumers, in times of crisis or robust growth, we all play a part in this new global enterprise called e-commerce where billions of light-weight parcels of various value are flown across the globe disrupting traditional businesses and putting many pricing models and entire sectors of the national economy under pressure. This disruption can affect not only airports and air cargo handlers, but entire supply chains as well.

E-commerce directly impacts profit margins in the air cargo industry and what’s driving these margins for so many businesses found down the supply chain deserves more attention and understanding. At the same time, these pressures are creating entirely new breeds of companies which will have lasting effects on the industry.

Let’s focus on some of the impacts e-commerce has had on the air cargo industry. These can be summarized into five basic categories. At the same time, we will examine how we might reconcile e-commerce with the transport of air cargo.

1. Trade integrators involved in e-commerce logistics bring little value to capital airports with slot scarcity

In a recent interview with CargoForwarder Global, mr. Bart Pouwels, head of cargo at Amsterdam Schiphol Airport, explicitly stated that there was little added value for airports and airport cargo communities in hosting global trade integrators like Alibaba or Amazon. Firstly, these traders tend to handle e-commerce goods autonomously and secondly, because cargo express services are performed at night, many capital airports cannot provide slots because of night flight restrictions.

Indeed, for many busy international airports which have little room for expansion and have restricted night flight capacity, e-commerce can be associated with more bother and expense than in delivering added value. This is why many regional airports in Europe, hungry for growth, are boasting about high slot availability. Along with integrator hub airports, they have turned themselves into major e-commerce facilitators and advocates.

2. E-commerce causes a growing gap between weight/volumes and number of AWBs

Even if busy capital airports with night restrictions shun global trade integrators, non-primary airports and express integrators (UPS, FedEx, DHL) own hubs that will provide the needed facilities and network for e-commerce.

But with e-commerce other challenges arise. In a recent survey initiated by CHAMP Cargosystems, a growing discrepancy between weight/volumes and number of AWBs has been found. (An air waybill is the industry’s most important document of title to goods). This has been largely due to the exponential growth of e-commerce. In other words, average air cargo shipments have become smaller and lighter.

As a carrier’s revenue is based on chargeable weight (either actual gross weight or volumetric weight depending on which is higher), carriers are relying more and more on volumetric weight hoping it will offset the drop in actual weight due to light ecommerce parcels.

But as e-commerce goods are primarily light packages which are consolidated, in most cases, by throwing together soft bulky bags to form a pile or stacking unstable boxes, carriers are suffering from inadequate volume measuring that further undermines their margins

Therefore air carriers, who fly e-commerce shipments, simultaneously face growing number of AWBs, much lighter cargo filling quickly all the available cargo space on the aircraft and actual chargeable weight not being correctly declared.

And it is not only air carriers who suffer from difficult-to-measure light volumetric cargo; air cargo handlers are also affected. To begin with, handling e-commerce requires more human resources on the ground for processing including consolidation and de-consolidation. Also the costs of cargo handler´s warehouse management systems (WMS) are often linked to the number of AWBs handled per month/year, which means the monthly/annual bill for air cargo handlers remains high.

3. Item vs Piece vs AWB-level tracking

E-commerce has also accentuated the debate over what level of tracking should be furnished in the air cargo industry. Currently, the tracking of air cargo shipments is done on an AWB level. The problem is that inside single AWB one can find 100 pieces/bags which in turn contain up to 10,000 small e-commerce parcels, and all of them, as said, included on a single AWB. Despite all the talk in the industry about full transparency, tracking does not go deeper than the AWB level.

Ensuring piece level tracking will mark a great leap forward as it will truly improve visibility. It will allow pieces in split shipments to be quickly located and ease the tracking of lost, missing or damaged bags and parcels. In this regard, a lot of hope is placed in IATA ONERecord data sharing standards to start providing information at the piece level. In turn, piece level tracking will improve the quality of handling e-commerce goods in the supply chain, increase efficiency and even improve margins for air cargo handlers.

For now, however, there is no comprehensive visibility in part-shipments of e-commerce goods within the supply chain. Airlines, air cargo ground handlers and forwarders are still in the dark as to what exactly is being shipped and in what quantities.

4. Does the air cargo handling business need to get involved in e-commerce logistics and to what extent?

The onset of e-commerce has provided air cargo handlers with a new type of challenge: do they need to engage in e-commerce and if so, to what extent? Should they turn themselves into e-commerce logistics companies and open up a side business? Are their current software solutions suitable for handling e-commerce goods? And what are the risks?

In technical terms, handling air cargo and handling e-commerce goods is rather similar. There is the physical component of receiving/releasing/transiting and there is the software and communication element including AWBs, security, consolidation or de-consolidation. The communication element consists of status messages exchanged with airlines and national customs offices, mainly sent utilizing Cargo-IMP or CargoXML messaging standards or through a conversion of data.

In fact, one of the cornerstones of e-commerce logistics – conversion of air cargo over to traditional postal or other alternative networks for the “last mile” – can be integrated into air cargo handling software platforms. The conversion, of course, is not physical but digital, yet, it is a must have for any e-commerce logistics company. Once converted into mail, the e-commerce shipment can utilize national postal networks and be delivered to even the most remote places at relatively low cost.

In this respect the most difficult task for e-commerce logistics companies is to convince national postal operators and local customs to grant a license which gives them permission to convert air cargo (e-commerce shipments fly as cargo) into mail in order to utilize these national postal delivery networks. Other delivery options, referred to as alternative networks (Fedex, DHL, UPS and various local logistics providers), can be more expensive and often do not reach remote areas.

However, the main difference between handling air cargo and e-commerce goods is not of a technical or technological nature, but a contractual one (!).

Air cargo handlers are, in most cases, neutral service providers who accept and prepare cargo for export, release import shipments, or handle freight in transit. The majority of their communication is with airlines, forwarders and national customs offices, and their major contractual obligations are usually with flight companies.

But getting involved in e-commerce logistics could cost the air cargo handler its customer base because many of its clients, particularly logistics and freight forwarding agents, might stop viewing it as a neutral player, and instead see it as a competitor stepping onto their turf.

This presents a potential threat to the core business of air cargo handlers as some forwarding companies could choose to work only with cargo handlers who stay neutral and do not enter into the delivery or logistics business. This is why it is unlikely that air cargo handlers will transform themselves into e-commerce logistics players as it could disrupt the supply chain to its core by eliminating the key element of trust.

The most likely way for cargo handlers to retain neutrality in the supply chain will be to provide physical handling services at the cargo terminal for e-commerce logistics companies as a subcontractor.

5. What software to use for air cargo handling and e-commerce logistics?

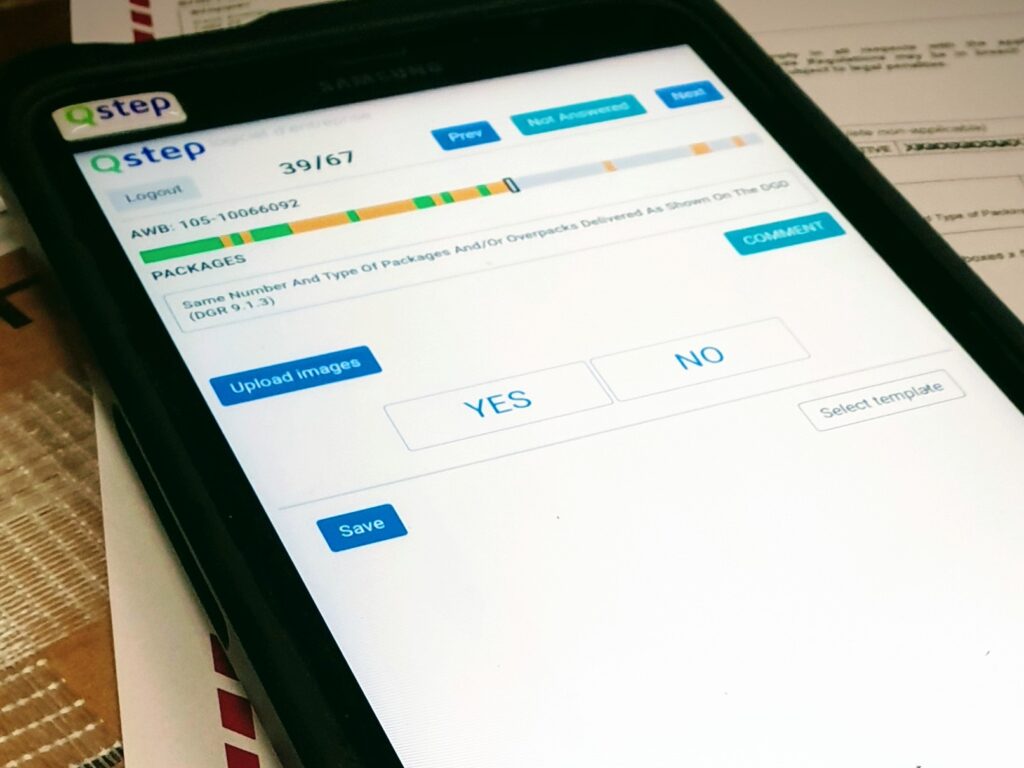

But what modes of cooperation can exist between air cargo handlers and e-commerce logistics companies? A win-win situation is implementable, but requires the right software on both sides. Air cargo handling companies need to have software which is not AWB centered while e-commerce logistics companies need software which enables them to have a comprehensive view of the movement of e-commerce goods from the country of origin to the country of destination up to and including the “last mile”.

Another essential feature in e-commerce logistics software is the ability to ensure conversion of e-commerce from air cargo status to a postal or other alternative “last mile” network. This includes physical re-labeling as well as the digital conversion of a shipment´s data and status.

The pricing logic around AWBs embedded with legacy software cuts margins for air cargo handlers even further, especially with the onslaught of light e-commerce parcels sent off by the millions. To minimize risks and keep margins intact, air cargo handlers need to seek new modern cargo handling software which is open to integration (API) and does not charge based on the number of AWBs handled.

Suffice to say that sustained or even improved margins could attract investors and third-party solution providers to the air cargo handling sector which has often been viewed as a low-margin business. And conversely, staying with legacy or AWB-centered software systems decreases margins and holds back the sector, making it unattractive to investors and third-party providers of modern solutions and services, as well as keeping it closed to new e-commerce opportunities and innovations.

However, with the right software, air cargo handlers could process e-commerce goods and become invaluable business partners and enablers for e-commerce logistics companies.

Good article and straight to the point. I don’t know if this

is really the best place to ask but do you people have

any ideea where to hire some professional writers? Thanks 🙂

Escape room lista

I used to be recommended this blog through my cousin. I’m not sure whether or not this submit is written by

way of him as no one else know such special approximately

my problem. You are amazing! Thank you!

My blog; homepage